Post

REPORT | The Portman Estate

3 Apr 2018

The Portman Estate is synonymous with Marylebone. Its Georgian residential architecture nestles within the West End’s commercial centres of Baker Street, Oxford Street and the Edgware Road. Executive Director of the Estate, Simon Loomes, shared the history and the 21st century vision for this important part of central London. Barry Coidan reports.

Simon took us on a high speed tour of The Portman Estate telling us about the Estate’s origins, its strategy and development programme as well as the exciting Business Improvement Districts and Public Realm initiative.

The Portman Estate is made up of two farms across Buckinghamshire and Herefordshire and the London Estate: 110 acres of prime property in Central London located between Oxford Street and the Edgware Road and extending north towards the Marylebone Road and east to Manchester Square. The Estate is made up of a mix of residential, retail and office properties - in total some 650 properties and 2,200 direct tenancies with a balance between short and long term investments ranging from 1 year to 125 year leases.

65 staff work in the Estate's management unit maintaining a high quality, high value letting portfolio aimed at delivering a vibrant community with a judicious mix of offices, shops and residential premises.

The Portman Estate is one of a number in London which include the Grosvenor Estate (Mayfair and Belgravia): the Cadogan Estate (centred on Sloane Street and the King’s Road):

the Howard de Walden Estate ( Marylebone) and the Crown Estate (Regent Street and much of St James’s).

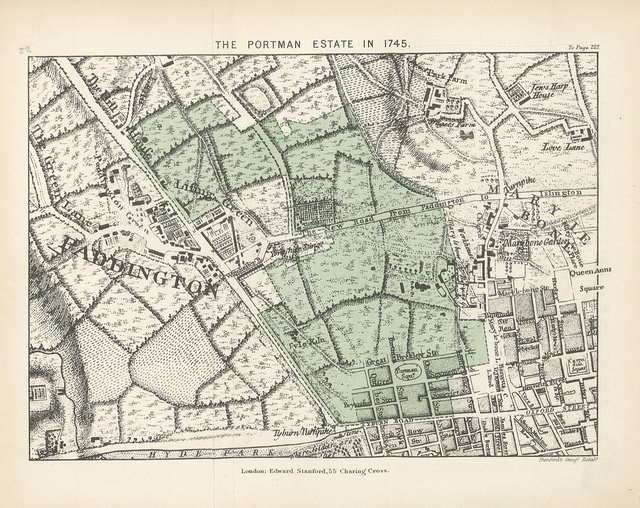

The Portman family were originally from the west country, farming some 10,000 acres in Somerset. The London estate’s origins lie in 270 acres of farmland two miles outside the City of London leased by Sir William Portman in 1532, who acquired the freehold 20 years later. Up until the 1760s the land remained in agricultural use - thereafter it was built upon and by the 1880s fully developed.

The size of the present day Estate is less than half of that originally purchased in the mid 16th century. The family deaths in the first half of the 20th century and the resulting taxation hit the Portman family hard. As well as selling all their land in the west country; after the death of the 7th Viscount in 1948 the remaining northern parts of the Estate were sold in 1951 and 1952.

The Estate’s Property strategy is centred around its residential properties (780 directly managed leases, 590 market lets and 100 statutory tenancies): office holdings (290 offices directly managed ranging in size from 150 to 46,000 sq ft) and retail and hotels (150 shops and restaurants of which 116 are directly managed and 27 leased hotels ranging from 30 to 1000 beds.

The Estate is held in trust for the benefit of the wider Portman family - there are some 9 or so property owning trusts with over 130 beneficiaries.

The 10th Viscount inherited the title in 1999 and this lead to a change in direction for the management of the Estate with an Estate Strategy aimed at protecting freeholds, providing good stewardship and sustainability and customer focus and service, and understanding and working with its partners.

Income growth is important and this is achieved by adding value through leasehold acquisition and lease restructuring. A significant risk is leasehold enfranchisement - tenant/ leaseholder acquiring the freehold of a property owned by the Estate. The effect is to chip away at the Estate’s income generating base. (To reduce this risk new leases and developments are restructured so as to create a premises that cannot be vertically separated from a connected structure without creating a flying freehold).

Income growth can be improved by influencing and shaping third party development by bringing in blue chip property partners. Also improving the physical fabric of the Estate’s assets is essential; adding value through redevelopment, refurbishment and maintenance. Finally, investing in the public realm - improving the feel, the atmosphere of an area plays an important part of the Estate’s property strategy.

In practice this means maintaining a healthy balance of use in the area, achieved by increasing direct control of the properties and attracting the appropriate mix of high end retail/restaurant offerings in Oxford Street, Baker Street and Edgware Road. Discount stores, banks, estate agents and internet cafes are discouraged!

Looking at specific areas, there is considerable potential for the regeneration of Edgware Road and Baker Street which as core business areas and as a key target for development and improvement. Oxford Street is problematic: currently it is not a world class place to visit or shop. Other streets on the Estate are being refashioned with a suitable mix of retail and business offerings, including New Quebec Street, George Street, Seymour Place and the upper half of Duke Street. Recent developments include 10 Portman Square - a Gateway building for Baker Street with offices and retail, along with Marble Arch House and the Chiltern Firehouse - a former 1870’s fire station converted into a luxury hotel. New Quebec Street, a short distance from Portman Square is the new “go to” district - full of up market boutique shops and restaurants. While 1-9 Seymour Place just off Portman Square is an office, residential and restaurant development. Regent House on Edgware Road has planning permission for a mix of offices, residential and retail. 1-4 Marble Arch will retain the existing facade but with a superb retail offering and offices above. Finally, there’s 19 -35 Baker Street where within a proposed new development of offices, housing and shops the existing private space - used for staff parking currently - will be opened up as a public realm.

The Portman Estate is actively involved in Business Improvement Districts - business led partnerships which are created through a ballot process to deliver additional services to local businesses. These are the Baker Street Quarter Partnership, the New West End Company and the Marble Arch Partnership which together with private and public sector partners seek to deliver improvement in the public realm. What is clear is that public realm quality drives the value of an area through a wide range of attributes. Character, Access, Amenity, Infrastructure, Well Being, Sustainability, Regulatory environment, Reputation and Community all contribute to the overall feel of an area.

One major detriment is traffic. For example Baker Street’s one way system has turned it into an urban motorway. As one resident said “It’s like little pockets with nothing together.” The aim is to drive out traffic, improve air quality by introducing two traffic flows with wider pavements. This is planned for delivery in January 2019. Other areas have similar problems due to the volume of traffic. Oxford Street is a bus lane. The area around Marble Arch, Oxford Street and Hyde park is fragmented. There’s nowhere to rest and take a breather. For something to change, however, requires a significant reduction in traffic and at the moment that’s not possible. The Estate is waiting for the moment however.

Questions from the floor ranged from what percentage of the Estate’s income went to the family and what competition The Portman Estate faced from the other West End family estates to the problem with high rise buildings.

As to the family‘s income Simon suggested a figure, but on assets which the Sunday Times estimates at around £1.5 billion, the Estate remains linked in part to an historic leasehold structure. The Estate is managed by a trustees acting on behalf of the various family beneficiaries. It’s managed internally with access to the best expert advice when required. There is little competition with the other Estates - each aiming to attract the best businesses to their areas to bolster London’s offer overall. What was important was to ensure that The Portman Estate attracted the right mix to ensure a vibrant community and street scene for a sustainable community feel. Get that right and the rest follows.

Finally Simon said that The Portman Estate had faced its more historic challenges like the other estates and is now looking ahead with optimism. The area grew up and changed organically - keeping this character and sense of place, and meeting the demands of the 21st century is a challenge. On the positive side the Estate’s full of old fashioned pubs!